Investor Relations

A unique combination of investment attributes offers shareholders safe, growing income and long-term capital appreciation

Disrupting $7 trillion real estate market with a more efficient capital solution and better customer experience

Throughout our 25-year history, we have dedicated ourselves to building innovative businesses that have provided better structured, value-enhancing capital to the real estate sector. Modernized ground leases represent the best opportunity yet to deliver on that mission and disrupt one of the largest capital markets in our country. Since iStar founded Safehold (NYSE: SAFE), SAFE's portfolio has grown to over $6b, a 18x increase from IPO in June 2017.

Superior principal safety

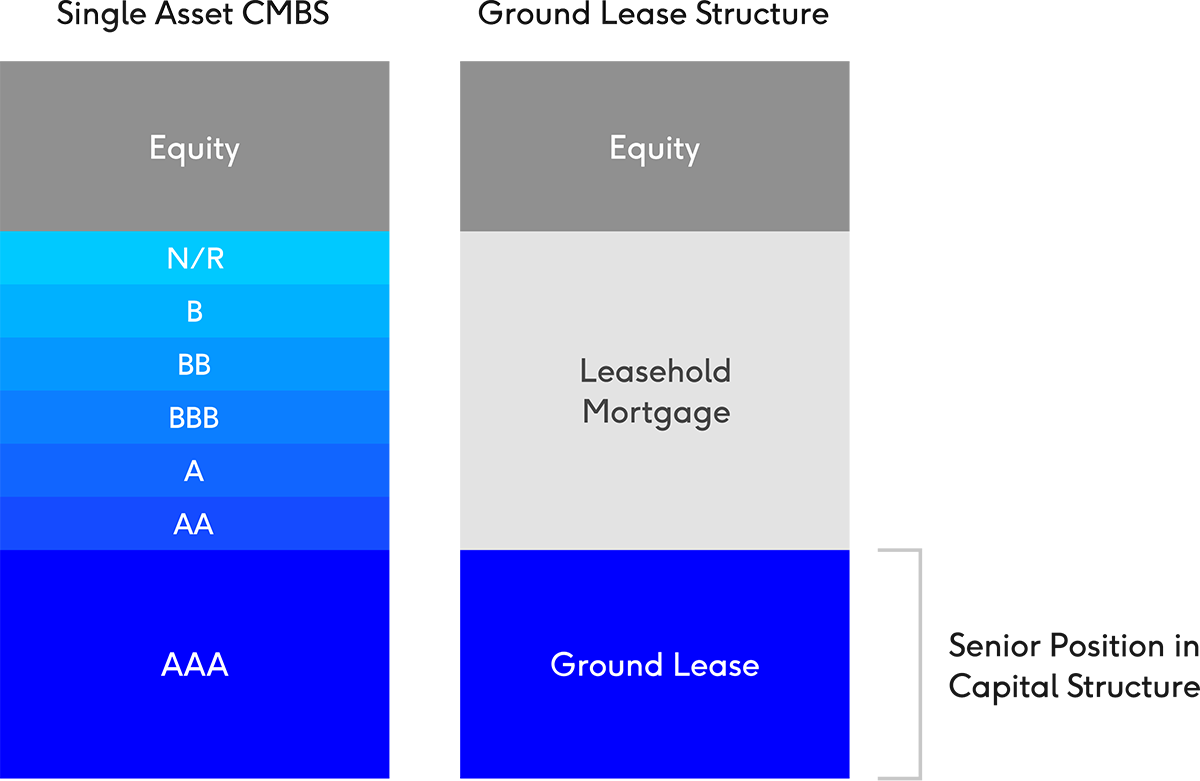

Our target ground lease represents the senior-most 30%-40% of a real estate capital structure and we target opportunities where our rent is covered approximately 3-5x by the building's cash flows. Assembling a large portfolio of these quality ground leases, diversified across the top 30 U.S. markets, by property type, and with strong real estate sponsors operating the buildings, further enhances the safety of our cash flow stream.

Attractive, long-term contractual cash flows

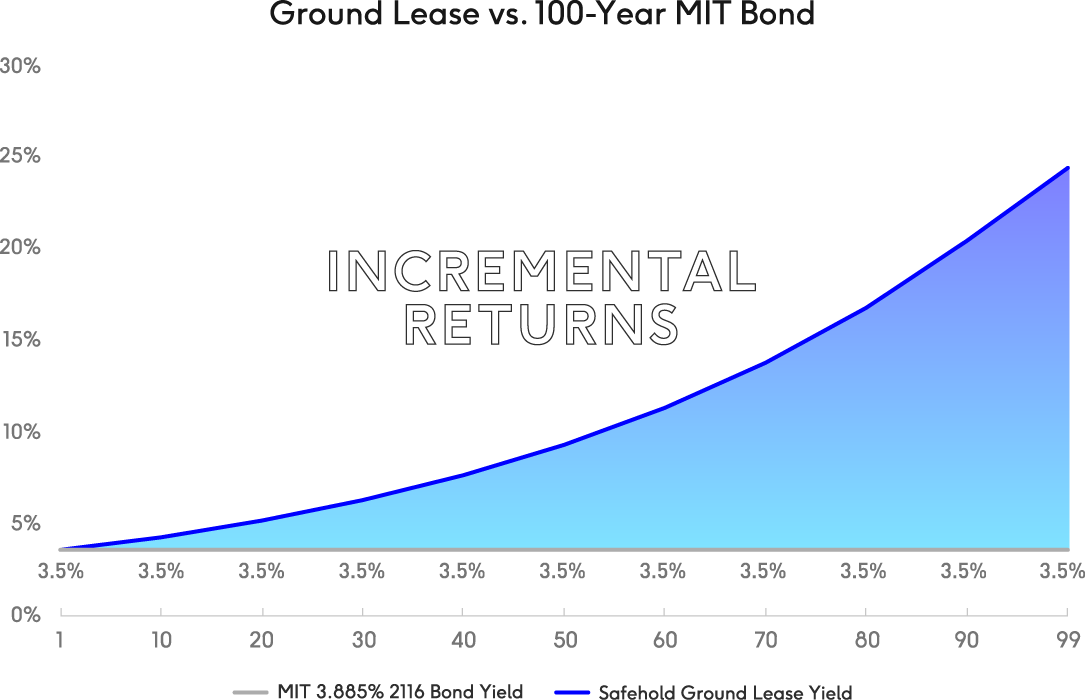

Contractual rent increases in Safehold's portfolio create long-term compounding cash flows that generate superior risk adjusted returns versus similar-risk, similar-maturity fixed income securities. A typical Safehold™ ground lease is structured with a first-year yield at between 3%-3.5% and 2% annual contractual rent increases for the term of the lease – delivering a yield to maturity of 5%-5.5%.

Building a machine that repeatedly creates excess returns in a large market is worth more

What’s more valuable than a static pool of assets that deliver excess returns? The wealth generating machine that consistently churns out new assets with excess returns by delivering customers a better capital solution in a $7 trillion market. Operational efficiency, low variable costs and a high rate of returning customers position the business for rapid growth in the years to come.

Further, we are accumulating a large store of wealth through the unrealized capital appreciation of our owned residual portfolio

Why is this important? Because unlike comparable bonds, Safehold doesn’t just get par back at maturity. At the end of the ground lease term, both the land and the building revert back to the landlord. That value can be substantially more than our original investment. Safehold takes the value of this unrealized capital appreciation and publishes it on a quarterly basis. And each time we acquire a new ground lease, this value continues to grow.

With a nationally diverse portfolio of future ownership interests that grows every time Safehold completes a new ground lease transaction, SAFE’s portfolio contains billions of dollars of unrealized capital appreciation with exponential upside in future years.

Unrealized Capital Appreciation (UCA) is calculated as today's estimated Combined Property Value less the aggregate cost basis of SAFE's portfolio. CBRE conducts independent appraisals of the CPV of each property(1). The Company formed a wholly-owned subsidiary called "CARET" that is structured to track and capture Unrealized Capital Appreciation.

Under a shareholder-approved plan, management has earned up to 15% of UCA(2), subject to time-based vesting.

Note: Please see the “Important Note re COVID-19” in the front of our Q3 SAFE 2022 earnings presentation for a statement about metrics this quarter.

(1) SAFE relies in part on CBRE’s appraisals of the Combined Property Value, or CPV, of our portfolio in calculating UCA. SAFE may utilize management’s estimate of CPV for ground lease investments recently acquired that CBRE has not yet appraised. For unfunded commitments on construction deals, CPV represents the cost to build inclusive of the ground lease. Please refer to our Current Report on Form 8-K filed with the SEC on July 22, 2021 and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, as updated from time to time in our subsequent periodic reports, filed with the SEC, for a discussion of risk factors related to these calculations. The Company formed a wholly-owned subsidiary called “CARET” that is structured to track and capture UCA to the extent UCA is realized upon expiration of our ground leases, sale of our land and ground leases or other certain events. Under a shareholder-approved plan, management has the right to participate in up to 15% of UCA under certain circumstances, subject to time-based vesting.

(2) See the Company’s 2019 proxy statement for additional information on the long-term incentive plan.

Our DNA as innovative thinkers has pushed us to create a growing company that can trade at a material premium to book

We believe the way to achieve this goal is by building a leadership position in a large, untapped market with superior risk-adjusted returns. Reinventing the ground lease sector has the potential to be the best business we have ever built – and we are deeply committed to seizing the opportunity on behalf of our shareholders.